Effective tax rate formula

Effective Tax Rate 95000 600000 158 Company B Annual Pre-Tax Earnings 900000 Total Taxes Paid 100000 10 400000 15 400000 25. The formula for a corporation can be derived.

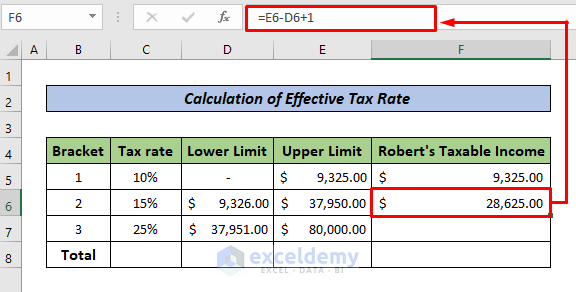

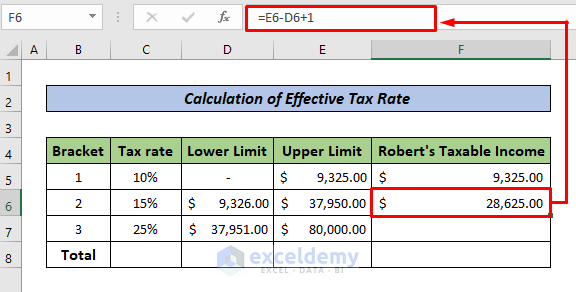

Excel Formula Income Tax Bracket Calculation Exceljet

Effective Tax Rate.

. It averages the amount of taxes you paid on all of your income. If you made 50000 last year and paid 10000 in taxes your effective tax rate was 20 percent since 10000 divided. Ad Leading Class Tax Tools and Technology to Help Businesses Stay Competitive.

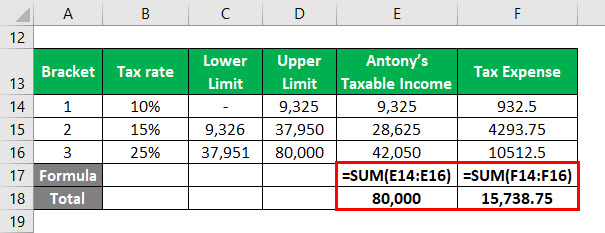

Average tax rate or effective tax rate is the share of income that he or she pays in taxes. Heres the formula. The average tax rate helps the government figure out how much tax was paid overall.

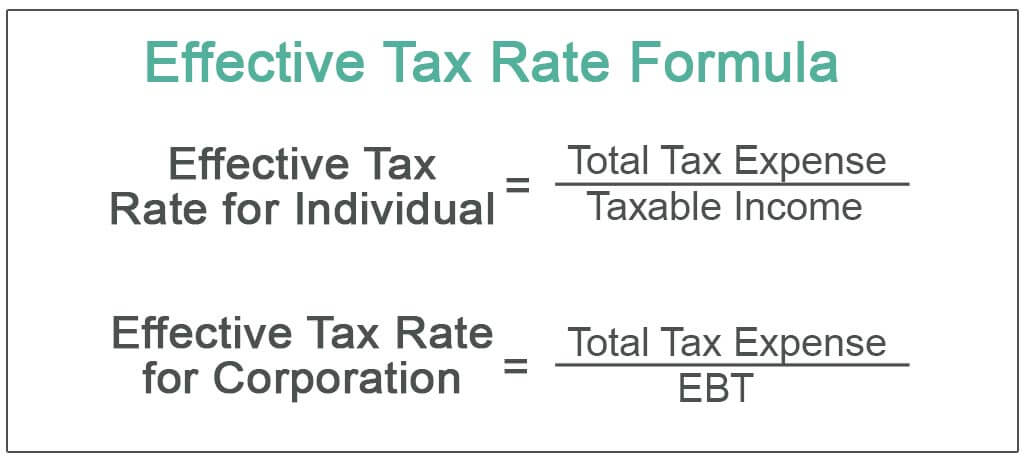

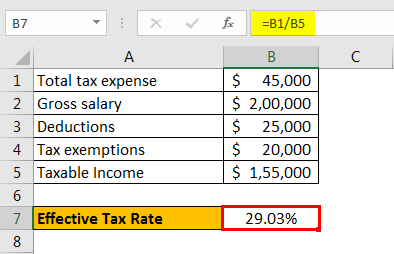

Effective income tax rate is the ratio of income tax to total income. Earnings before tax EBT. To calculate your effective tax rate you need to know two numbers.

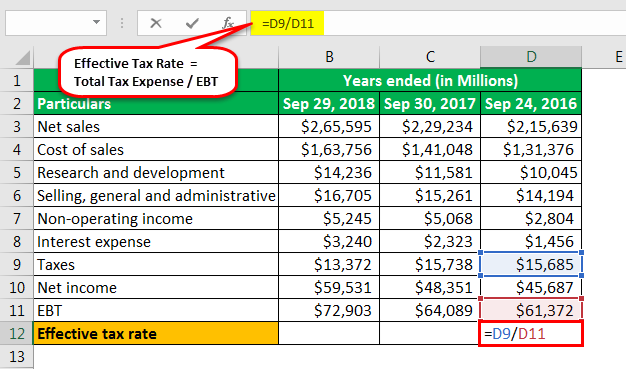

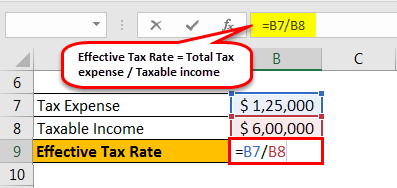

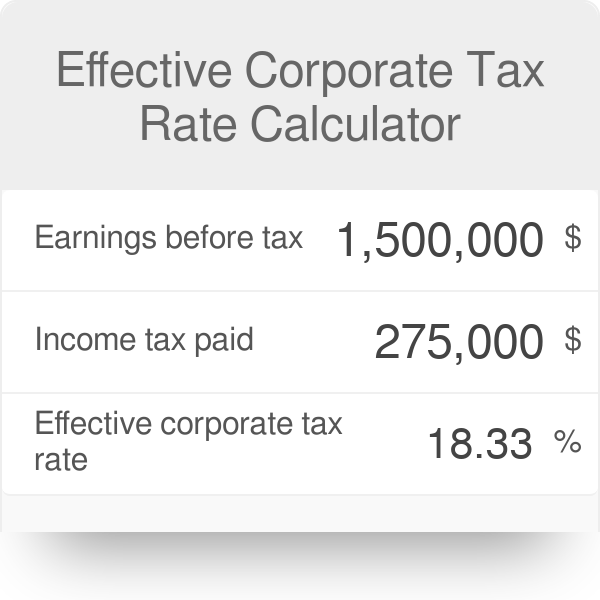

Your effective tax rate is expressed as a percentage. For corporations the effective tax rate can be found by dividing the tax expense by the earnings before tax of the company. Financial Services Firms are Investing in New Tax Technologies.

Your effective tax rate is different. Effective Tax Rate Income Tax Expense Earnings Before Taxes EBT. Equation for calculate effective tax rate is Tax Rate Income Tax Expenses Pretax Income 100.

Because of the refundable credits the resulting net tax could be negative if the amount of these credits is greater than the. To calculate your effective tax rate divide your taxes paid by. 3 To calculate this rate take the sum of all your lost income and.

Is Your Business Ready. Your total earnings and total tax bill. The effective tax rate is the tax divided by the income.

To calculate your individual propertys effective tax rate all you have to do is divide your annual tax bill by what you estimate to be the market value of your property. In case of an individual it is calculated by dividing tax payable by total income and in case of a corporation. The effective tax rate can be calculated for historical periods by dividing the taxes paid by the pre-tax income ie.

Effective Tax Rate Formula. The effective tax rate for individuals is found by. Finally calculate the effective tax rate of the individual by dividing the total tax expense by the taxable income as shown above.

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Net Operating Profit After Tax Nopat Formula And Calculator Excel Template

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Definition Formula How To Calculate

How To Calculate Federal Tax Rate In Excel With Easy Steps

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula And Calculation Example

Cost Of Debt Kd Formula And Calculator Excel Template

Effective Corporate Tax Rate Calculator

Effective Tax Rate Formula Calculator Excel Template

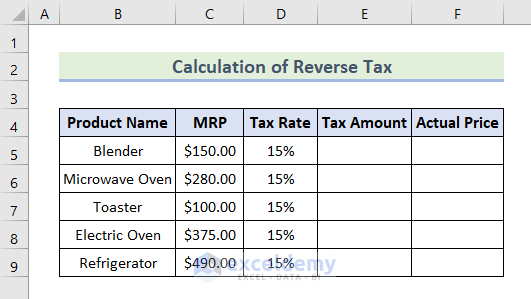

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

Effective Tax Rate Formula And Calculation Example